If you’re looking for potentially lucrative stock picks, billionaire Ken Griffin’s recent investments may catch your attention. Having poured millions of dollars into two “strong buy” stocks, Griffin’s choices have piqued the curiosity of investors. While the reasons behind his investments are not explicitly mentioned, following in his footsteps could prove to be a profitable move.

This image is property of s.yimg.com.

Background Profile of Ken Griffin

Brief Biography of Ken Griffin

Ken Griffin, born in 1968 in Daytona Beach, Florida, is a prominent American investor and hedge fund manager. He is the founder and CEO of Citadel, a leading financial institution in the investment industry. Griffin has a remarkable track record of success and is widely considered one of the most influential hedge fund managers in the world.

Griffin’s Success in Hedge Funding

Griffin’s success in hedge funding can be attributed to his exceptional talent and astute investment strategies. His journey in the financial world began at a young age, when he started investing in stocks during his freshman year at Harvard University. After graduating, Griffin founded Citadel in 1990 with an initial investment of $4.6 million. Over the years, his company has grown exponentially and currently manages over $35 billion in assets.

A Look at Griffin’s Company Citadel

Citadel, based in Chicago, Illinois, is a global investment firm that operates across a range of asset classes. The company’s diverse portfolio includes hedge funds, equity funds, fixed income funds, and quantitative strategies. Citadel’s success can be attributed to its innovative approach to investing, cutting-edge technology, and a team of talented professionals led by Ken Griffin. With a strong focus on risk management and consistent returns, Citadel has established itself as a leader in the financial industry.

Understanding Griffin’s Investment Strategy

Griffin’s Approach to Stock Investing

Griffin’s approach to stock investing is driven by a deep understanding of market dynamics and extensive research. He believes in a disciplined and data-driven approach that combines quantitative analysis with qualitative insights. Griffin and his team at Citadel utilize sophisticated algorithms and technology to identify investment opportunities in the stock market, seeking to capitalize on both short-term fluctuations and long-term trends.

Factors He Considers in Making Investment Decisions

In making investment decisions, Griffin considers a range of factors to assess the potential risks and rewards of a stock. These factors include fundamental analysis, market trends, financials, competitive advantage, management team, and industry dynamics. Griffin places great emphasis on understanding the underlying business and its growth potential, as well as assessing the overall macroeconomic environment.

Griffin’s Investment Philosophy Explained

Griffin’s investment philosophy revolves around the core principles of long-term value creation, discipline, and risk management. He believes in maintaining a diversified portfolio to minimize risk and generate consistent returns over time. Griffin is known for his ability to identify undervalued companies and take advantage of market inefficiencies. He also emphasizes the importance of adapting to changing market conditions and continually refining investment strategies.

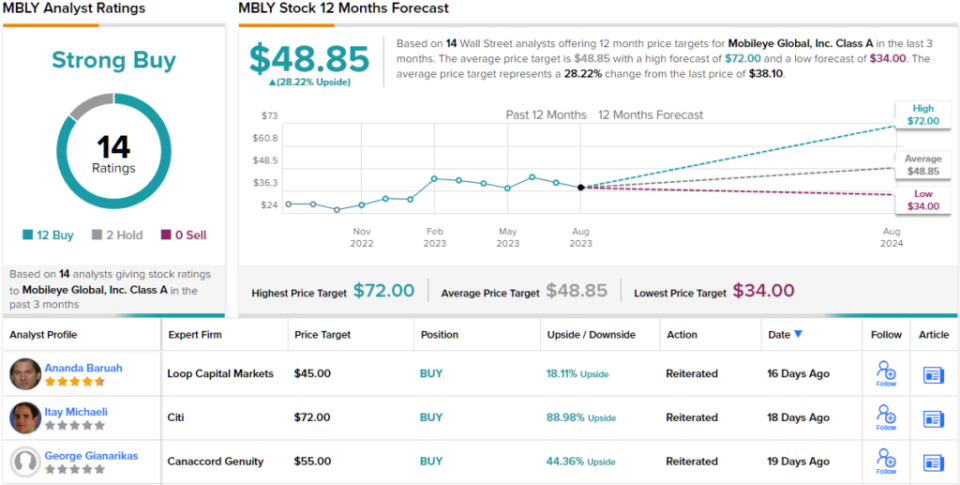

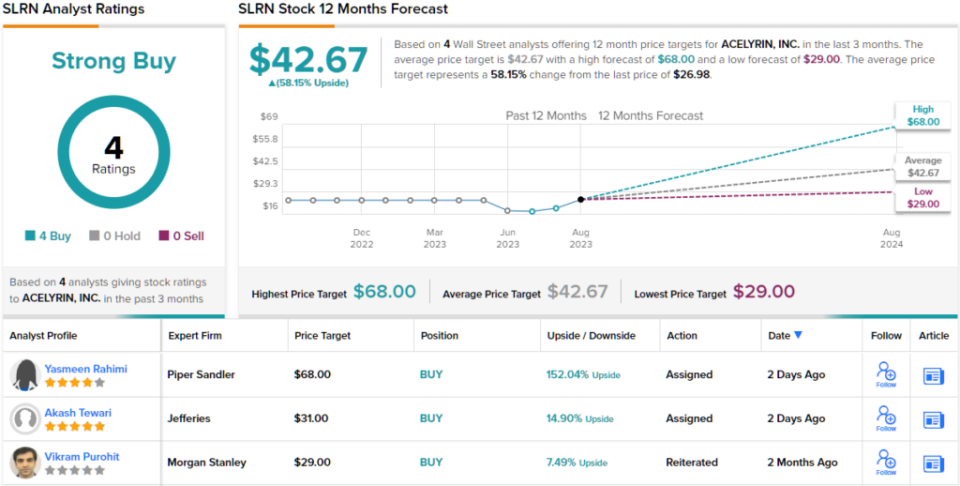

Griffin’s ‘Strong Buy’ Stocks

Identification of the ‘Strong Buy’ Stocks

Ken Griffin’s recent investment in two “strong buy” stocks has attracted significant attention in the investment community. However, the specific details and reasons behind his decision to invest in these stocks are not mentioned in the available summary. Further analysis is necessary to understand the factors that prompted Griffin to identify them as potential opportunities.

Overview of Griffin’s Investment in These Stocks

While the overview of Griffin’s investment in these “strong buy” stocks is not available, it is important to note that his investment decisions are often well-researched and based on comprehensive analysis. Griffin and his team at Citadel have a history of success in identifying potential winners in the stock market, and any investment made by him is likely to be based on thorough due diligence and a deep understanding of the companies in question.

The Current Performance of the ‘Strong Buy’ Stocks

Without access to specific details regarding the “strong buy” stocks, it is not possible to assess their current performance or how they have fared since Griffin’s investment. Monitoring the performance of these stocks and tracking their progress over time can provide insights into the efficacy of Griffin’s investment decisions and the potential returns they may generate.

Why Griffin Chose These Stocks

Analyzing the Factors Attracting Griffin to These Stocks

While the reasons behind Griffin’s decision to invest in these particular stocks are unknown, it is reasonable to assume that he weighed various factors in the selection process. Griffin is known for his meticulous research and analysis, considering elements such as the company’s financial health, growth prospects, competitive advantage, and overall market conditions. By identifying and evaluating these factors, Griffin may have identified a significant opportunity for future growth and returns.

Understanding How These Stocks Fit Into Griffin’s Broader Investment Strategy

The two “strong buy” stocks chosen by Griffin likely play a role in his broader investment strategy. Griffin’s investment approach is multidimensional and may involve diversification across different sectors and asset classes. By analyzing how these stocks fit into his portfolio, it can provide insight into his overall investment strategy, risk appetite, and long-term goals.

Experts’ Insights Into Griffin’s Choices

While specific insights from experts regarding Griffin’s choices are unavailable, it is worth noting that Griffin’s investment decisions often attract attention from analysts and industry professionals. Experts may offer different perspectives on the potential of these stocks, the suitability of Griffin’s investment strategy, and the overall market outlook. Analyzing these insights can help deepen our understanding of Griffin’s choices and their potential impact.

This image is property of s.yimg.com.

The Returns on Griffin’s Investments

Historical Return Statistics

Griffin’s investment track record is impressive, and his ability to deliver consistent returns has contributed to his success. However, without specific details on the stocks involved, it is not possible to evaluate the historical return statistics of these particular investments. Monitoring the performance of Griffin’s overall portfolio over time and comparing it to relevant benchmarks can help gauge the success and effectiveness of his investment strategies.

Comparing Griffin’s Returns to the Broader Market

Griffin’s returns are often compared to the broader market to assess his performance relative to industry benchmarks. Given the available information, it is not possible to make direct comparisons at this time. However, historical data and performance analysis can provide insights into how Griffin’s investments have fared compared to market indexes such as the S&P 500 or relevant sector indices.

Discussion on the Impact of These Investments on Griffin’s Overall Wealth

Griffin’s investments, alongside his successful management of Citadel, have contributed significantly to his overall wealth. However, the specific impact of these recent investments on his wealth cannot be determined without further information. Nevertheless, it is reasonable to expect that successful investments play a crucial role in generating substantial wealth for Griffin, reinforcing his influence and standing in the financial industry.

Riding Ken Griffin’s Coattails

Benefits of Modelled Investment Off Griffin’s Picks

Riding Ken Griffin’s coattails, or replicating his investment choices, can potentially bring several benefits to investors. Griffin’s expertise, extensive research, and successful track record make his investment decisions valuable insights. By modeling investments off Griffin’s picks, investors can gain exposure to potential winners and benefit from his extensive knowledge of the market.

Cases of Successful Copies of Griffin’s Stock Selections

Over the years, there have been instances where investors who followed Griffin’s investment choices have experienced success. By studying and analyzing the factors that led to these successes, investors can gain insights and potentially replicate these models in their own investment strategies.

Considerations Before Riding the Coattails

While riding Ken Griffin’s coattails can be beneficial, it is crucial for investors to consider individual risk tolerance, financial goals, and investment horizons. Griffin’s investment choices may not align perfectly with every investor’s circumstances, and adjustments should be made accordingly. Additionally, thorough research and due diligence should be conducted before replicating any investment model to understand the potential risks and rewards involved.

This image is property of s.yimg.com.

Griffin and Tech Stocks

Analyzing Griffin’s History with Tech Stocks

Ken Griffin has demonstrated a keen interest in the technology sector throughout his career. He recognizes the potential for innovation, disruption, and growth within this industry, leading to his involvement in various tech-related investments. Griffin’s history with tech stocks showcases his ability to identify opportunities within this dynamic sector and profit from long-term trends.

Dominance of Tech Stocks in Griffin’s Portfolio

Tech stocks have historically held a significant position in Griffin’s investment portfolio. The rapid growth, scalability, and transformative nature of technology companies make them attractive investments. Griffin’s portfolio likely includes a mix of established tech giants and emerging startups, providing exposure to a range of opportunities within this sector.

Griffin’s Outlook on the Tech Industry

While specific insights into Griffin’s outlook on the tech industry are not available, it is reasonable to assume that he maintains a positive outlook based on his investment history and involvement in tech-related ventures. Griffin recognizes the potential for future growth and innovation within the sector, which aligns with his investment philosophy of identifying long-term value and capitalizing on market trends.

Griffin’s Strategy Changing Over Time

Insight Into Any Evolution of Griffin’s Strategy

Griffin’s investment strategy has evolved over time, adapting to changing market conditions and shifting economic landscapes. He stays informed about emerging trends, continuously refines his investment processes, and incorporates new technologies. By keeping abreast of market developments and adjusting his strategy accordingly, Griffin aims to optimize returns while managing risks effectively.

Understanding How Recent Market Events Have Impacted Griffin’s Approach

Market events and economic conditions have a significant impact on investment strategies, including Griffin’s approach. The COVID-19 pandemic, for instance, prompted adjustments that took into account the volatility and uncertainty in the global markets. By closely monitoring market events, Griffin is able to make informed decisions and navigate through challenging times while capitalizing on new opportunities.

Comparing Griffin’s Current and Former Investment Picks

Comparing Griffin’s current investment picks to his previous choices can provide insights into his evolving investment strategy. Changes in sector focus, asset allocation, or the types of investments made may indicate shifts in his outlook or adapting to market conditions. Analyzing these changes can provide valuable lessons for investors seeking to better understand Griffin’s investment approaches and decision-making processes.

This image is property of s.yimg.com.

Criticism and Controversies Surrounding Griffin

Depiction of Past and Recent Controversies

Ken Griffin, as a high-profile billionaire, has encountered criticism and controversies throughout his career. His immense wealth, involvement in the financial industry, and political contributions have sometimes placed him in the spotlight. Criticisms have ranged from concerns about the concentration of power and influence to controversies surrounding tax policies and regulatory matters. It is important to consider different perspectives and weigh the impacts of these controversies on Griffin’s investments and public perception.

Discussion on the Impact of Controversies on His Investments

Controversies surrounding Griffin can potentially impact his investments, as public perception and sentiment can influence stock prices and market dynamics. Negative attention may result in increased scrutiny, regulatory investigations, or reputational damage, potentially affecting the performance of investments tied to him. However, it is important to note that the scale and extent of these impacts can vary, and Griffin’s success may often overshadow short-term controversies.

Understanding How Griffin Handles Criticisms

Griffin has displayed resilience and has been adept at addressing criticisms throughout his career. He has utilized various means to address controversies, including public statements, engagement with regulators and lawmakers, and philanthropic initiatives. By actively addressing and managing criticisms, Griffin strives to protect his reputation while steering his investments towards continued success.

Forecast of Griffin’s Future Investments

Predictions of Griffin’s Next Investments

Forecasting specific investments that Griffin will make in the future is challenging due to the complexity of his investment strategy and the constantly evolving market environment. However, based on his historical preferences and the prevailing market trends, it is possible to make some predictions. Griffin may continue to focus on sectors such as technology, finance, and healthcare, while also exploring emerging opportunities in sectors such as renewable energy or artificial intelligence.

Expected Impact on Market From Griffin’s Future Investments

Griffin’s future investments, given his substantial influence and considerable capital, can potentially impact the market significantly. His involvement in a particular stock or sector may attract attention from other investors and can influence stock prices and market sentiment. The impact will depend on the size of the investment, the market conditions, and the level of confidence it instills in other market participants.

Opinion on What Sectors Griffin May Prioritize

While the specific sectors Griffin may prioritize in the future are speculative, some areas of potential interest can be identified. Continued focus on technology and innovative industries is likely, given Griffin’s history and his ability to identify long-term trends. Additionally, sectors such as renewable energy, healthcare, and financial technology may present compelling opportunities that align with Griffin’s investment philosophy and offer potential for significant growth.

In conclusion, Ken Griffin’s background profile, investment strategy, and track record of success make him a prominent figure in the investment world. While specific details about his recent investments and reasons behind his choices are not available, analyzing his investment philosophy, evolving strategies, and past successes can provide valuable insights. Riding Ken Griffin’s coattails can be a potentially beneficial approach for investors, but careful consideration, thorough research, and understanding individual circumstances are essential. As Griffin’s investment choices continue to shape the market and generate substantial wealth, the anticipation of his future investments and their impact remains exciting.

This image is property of s.yimg.com.